Fewer people should have to pay tax on gifts given just before death, under proposals for a major overhaul of the inheritance tax system.

At present, when someone dies within seven years of passing on money, property or possessions to loved ones, tax of up to 40% must be paid.

The Office of Tax Simplification (OTS) has suggested that this deadline should change to five years.

The OTS also said the tax should be made much easier to understand.

If the changes are approved by the Treasury, it could affect the finances of those who are financially planning in older age, and their younger relatives – many of whom are said to be relying on inheritance.

How does inheritance tax work?

Inheritance Tax is a tax on the estate – the property, money and possessions – of someone who has died. However, no tax is paid if the estate is valued at less than £325,000 or if anything above this threshold is left to a husband or wife, civil partner, charity, or a community amateur sports club.

Fewer than 25,000 estates are liable for the tax each year. That equates to less than 5% of all deaths.

However, 10 times as many estates need to complete and submit forms to check whether they are liable for the tax.

The tax is a major political battleground, partly owing to the fact many people are concerned about the tax and find it difficult to understand.

In January last year, Chancellor Philip Hammond asked the OTS to carry out a review.

Kathryn Cearns, who chairs the OTS, said: “Although only a small number of people pay inheritance tax each year, a far greater number worry about it. The OTS’s packages of recommendations would go some way to achieving the goal of making the tax easier to understand and simpler to comply with.”

What is the plan for gifts?

At present the rules are complicated. Anyone can give away £3,000 worth of gifts each tax year without them being added to the value of the estate. If unused, this allowance can be carried over to the following year, up to a maximum of £6,000.

They can also give up to £250 to anyone else. There is yet another allowance for gifting money towards wedding costs. A gift is also generally discarded for tax purposes if it is funded out of income, as opposed to savings.

It also proposes that the range of allowances is scrapped and replaced with a single, higher, annual gift allowance.

Usually it is the estate which is liable for inheritance tax. However, a recipient of a gift, if the giver has died within seven years, and has already given away more than £325,000, could be liable to pay inheritance tax.

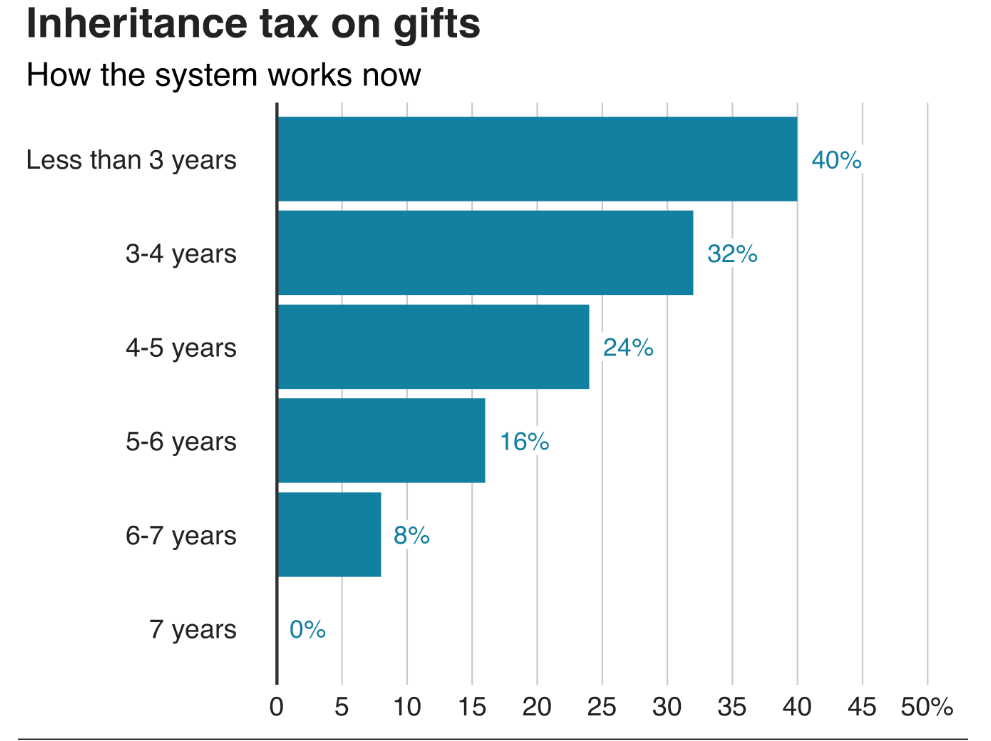

To add to the complication, the level of tax is determined by the length of time between the gift and death.

If the individual does not pay the tax within 12 months, generally because they have already spent it, then the estate of the giver becomes liable.

Bill Dodwell, OTS Tax Director, said: “The taxation of lifetime gifts is widely misunderstood and administratively burdensome.”

The rules have not changed since the 1980s, but now the OTS has suggested that the seven-year rule is cut to five years, owing to the difficulty of finding paperwork that goes so far back.

What has been the reaction to this plan?

Some suggest that scrapping the existing taper system would mean some gift recipients face a larger tax bill.

Laura Suter, from investment firm AJ Bell said: “The suggestion of reducing the seven years down to five and scrapping taper relief entirely looks like a bald tax grab and revenue-raising move.

“Instead the taper could be simplified into a two-step process, for example, or if it is scrapped entirely then the period should be shorter than five years.”

The Treasury, which commissioned the report, said it would “consider the OTS recommendations carefully and will respond in due course”.

What other changes to inheritance tax have been suggested?

Some of the other recommendations in the report cover the link between inheritance tax and capital gains tax.

Currently, there is no capital gains tax paid on death and the report suggests that this puts people off passing on assets to the next generation during their lifetime.

It said that capital gains tax rules should be changed as a result. Some suggest this could make the system more complicated again.

However, it makes no recommendations surrounding one of the most complex areas of inheritance tax – the rules allowing people to leave their family home to their descendants.

The rule for scrapping inheritance tax on homes up to £1m was a major policy of the David Cameron Conservative government.

Source BBC